This week, the Marijuana Policy Project (MPP) released a new report on tax revenue generated from state-legal, adult-use cannabis.

As of the end of 2022, states have reported a combined total of more than $15.1 billion in tax revenue from legal, adult-use cannabis sales since 2014 when sales began in Colorado and Washington. In 2022 alone, legalization states generated more than $3.77 billion in cannabis tax revenue from adult-use sales.

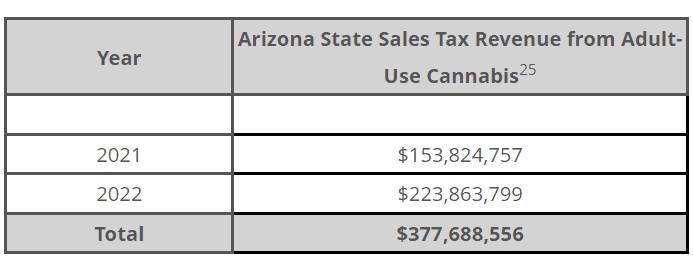

In Arizona, voters approved an initiative regulating cannabis for adults’ use on November 3, 2020. Sales from existing medical cannabis businesses began on January 21, 2021.

In its second year of legal sales, Arizona brought in nearly $224 million in cannabis excise taxes and transaction privilege taxes on adult-use cannabis. After regulatory and enforcement costs are paid, Arizona’s law distributes a third of the cannabis tax revenue to community colleges, along with 10% to public health and criminal justice programs.

Although cannabis sales have continued to generate billions in annual tax revenue, 2022 marked the first year with a decrease in tax revenues compared to the prior year. Even as new states came online, there was a slight decrease in total state cannabis tax revenue — from over $3.86 billion in 2021 compared to $3.77 billion in 2022. Prior to 2022, every legalization state had seen annual increases in cannabis tax revenue. However, six states with the most mature legalization laws experienced decreases in cannabis tax revenue over the past year, while newer legalization states generated more cannabis tax revenue in 2022 than in 2021. It is important to note that while ’22 figures were down from ’21 in more mature markets, they were still higher than any year pre-COVID for each state.

“States that have made the decision to legalize and regulate cannabis are benefiting from hundreds of millions in tax revenue each year. These new streams of revenue are helping to fund crucial social services and programs across the country, such as education, alcohol and drug treatment, veterans’ services, job training, and reinvestment in communities that have been disproportionately affected by the war on cannabis. The states that lag behind will not only be doing a disservice to their constituents — they will also be leaving money on the table,” said Toi Hutchinson, President and CEO of the Marijuana Policy Project.

Twenty-two states have passed laws to legalize cannabis possession for adults 21 and older. All but two of them — Maryland and Virginia — have also legalized, regulated, and taxed cannabis sales. (However, Maryland Gov. Wes Moore is expected to sign a bill to legalize and regulate sales.) Several other states are building strong momentum to legalize adult-use cannabis in 2023, including Minnesota, New Hampshire, and Ohio.

2022 State-by-State Totals:

• Alaska: $28,649,408

• Arizona: $223,863,799

• California: $1,074,560,287

• Colorado: $305,034,034

• Illinois: $562,119,019

• Maine: $25,329,534

• Massachusetts: $250,710,415

• Michigan: $326,049,074

• Montana: $41,989,466

• Nevada: $196,952,338

• New Jersey: $20,139,655

• New Mexico: $36,684,235

• Rhode Island: $579,439

• Oregon: $150,316,424

• Washington: $529,443,420

• Vermont: $2,363,000

Year-by-Year Totals:

• 2014: $68,503,980

• 2015: $264,211,871

• 2016: $530,521,110

• 2017: $736,534,982

• 2018: $1,308,693,928

• 2019: $1,749,459,667

• 2020: $2,814,837,199

• 2021: $3,866,974,690

• 2022: $3,774,783,548

• CUMULATIVE TOTAL: $15,114,520,975

Images: MPP

AZ Marijuana Arizona Marijuana Info

AZ Marijuana Arizona Marijuana Info