Arizona generated more tax revenue from legalized marijuana sales than from tobacco and alcohol combined in March of 2022, state data shows.

Tax deposits to the state’s general fund from medical and recreational cannabis sales reached nearly $6.3 million in March, compared to $1.7 million from tobacco and $3.7 million from alcohol sales, according to the Arizona Joint Legislative Budget Committee (JLBC).

Beyond that $6.3 million in marijuana tax dollars for the general fund, marijuana excise taxes separately exceeded another $11.9 million last month, for a total of $18.2 million in total revenue—most of which goes to the state, with smaller portions being distributed to cities and counties.

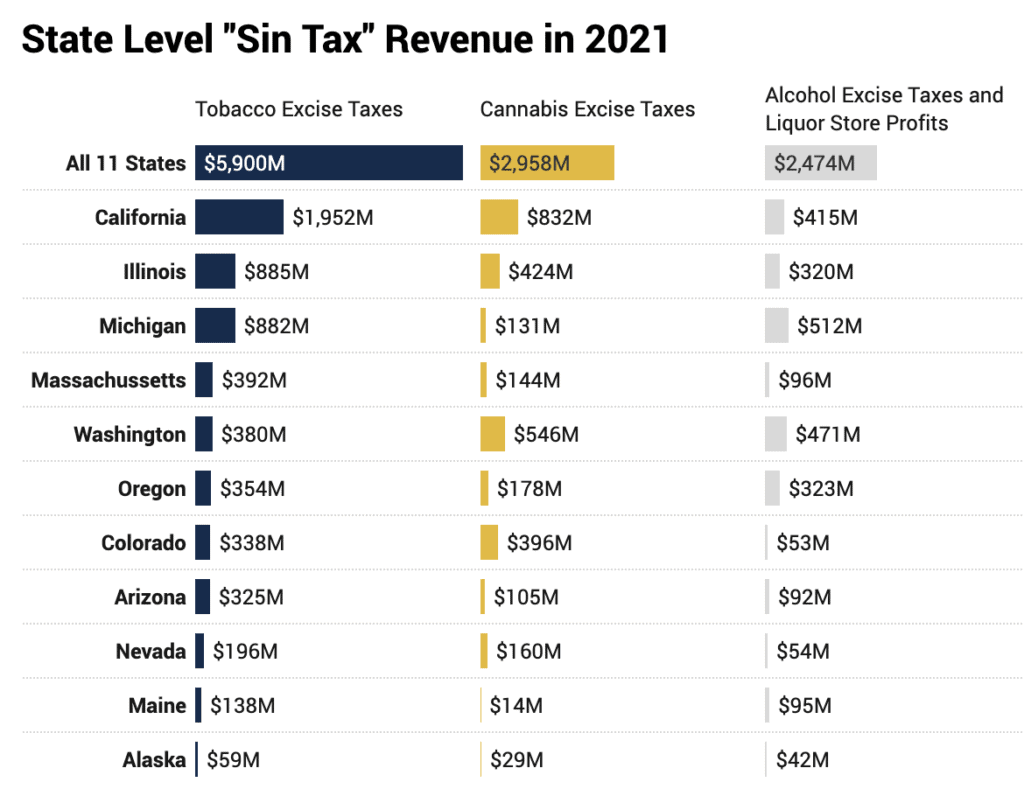

In 2021, Arizonans spent over $1.4 billion on marijuana at state-licensed dispensaries, and the state received $105 million from the cannabis excise tax.

Photo: ITEP

AZ Marijuana Arizona Marijuana Info

AZ Marijuana Arizona Marijuana Info